International students have been drawn to the US for decades, where they are met with a multitude of top-tier universities with world-class academic programs and opportunities to be at the forefront of American research and innovation. The US benefits immensely from international students, who contribute to the overall economy, the financial health of US educational institutions, and the workforce. Despite the critical contributions of international students, new research shows the US has become complacent in its role as a global leader in education and has not kept pace with other leading countries’ efforts to recruit and retain the top international students worldwide.

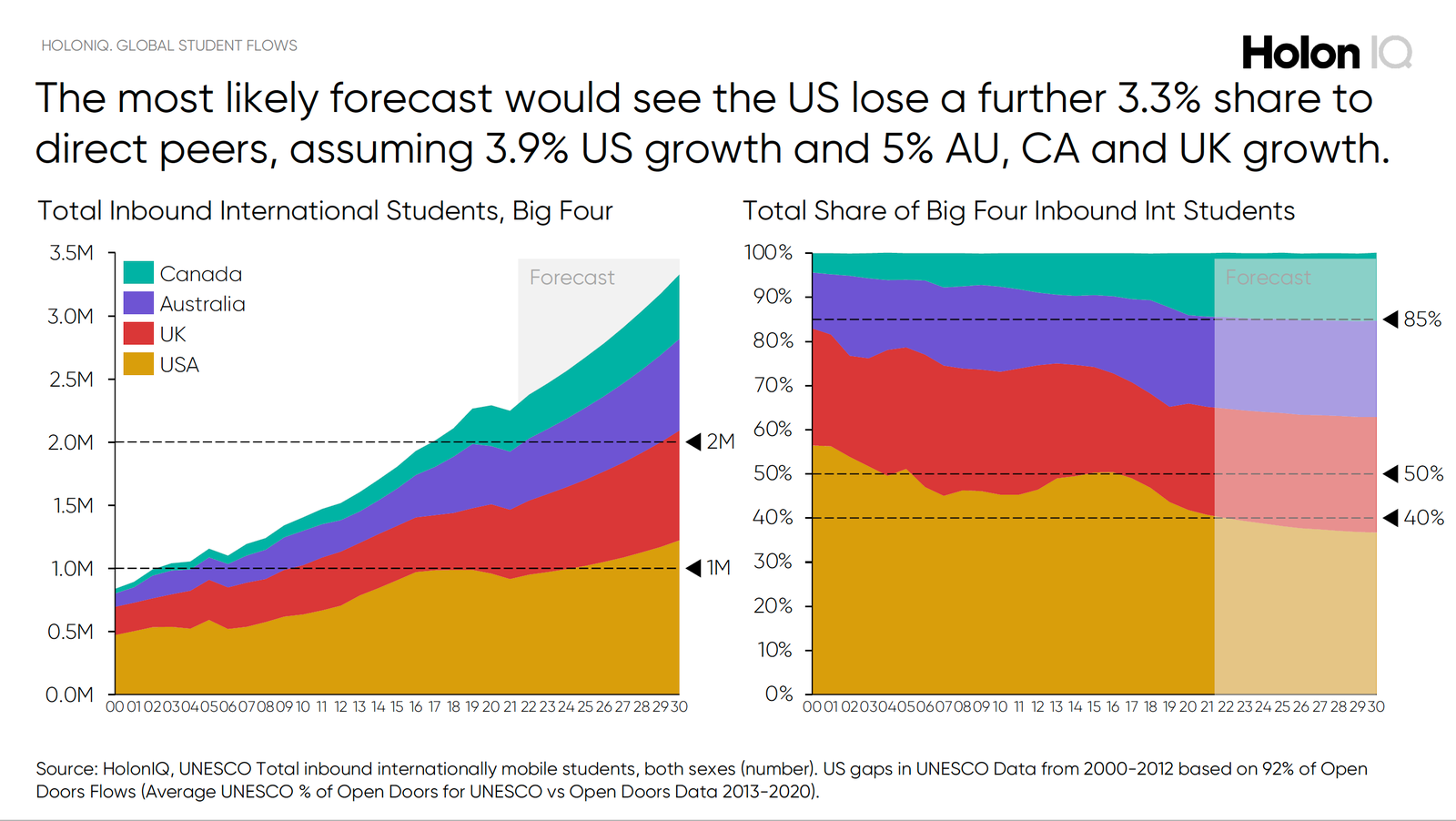

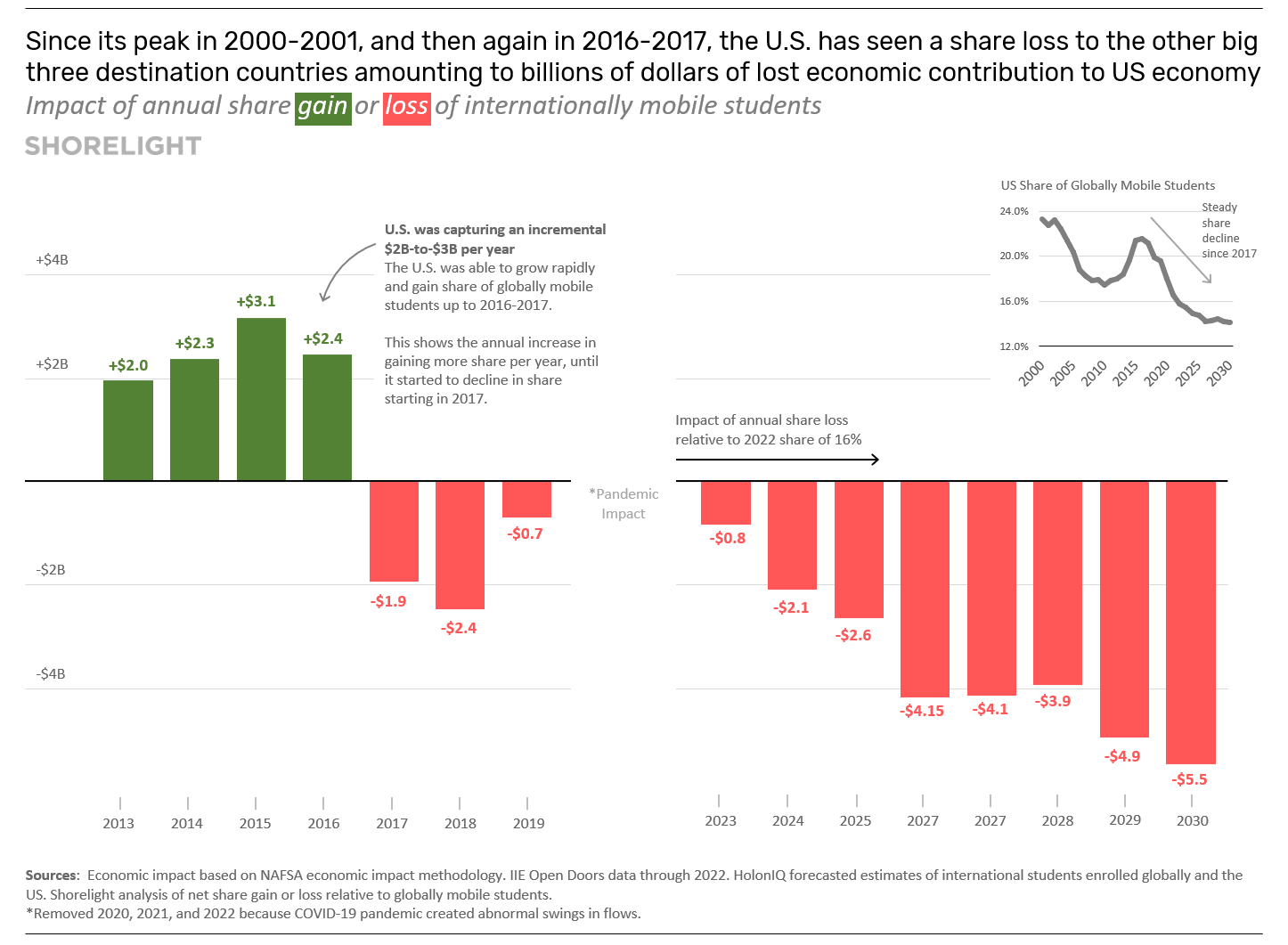

New data from HolonIQ that forecasts global student flows shows that despite growing demand for an education abroad, the US share of those students has been slowly eroding for 20 years, costing the US billions of dollars and thousands of jobs. Approximately 9 million students, representing more than $500B in annual direct expenditure, will travel to study outside their home country by 2030. And over the next 30 years, the world is expected to produce 1 billion post-secondary graduates, many of whom will be interested in an English-based degree or credential. Other leading destination countries like Australia, Canada, and the UK have adopted intentional and coordinated policies to grow their share of the millions of current and future mobile international students, and as a result, the US has experienced an approximate 20% loss in share over the last two decades.

Given the continued expansion of favorable policies or “pull factors” among competitor countries, an analysis of the long-term demand shows the US could lose another 3.3% market share by 2030. Without policy intervention, the lure of a US education alone is no longer enough, and the US could fail to attract the robust and diverse talent pipeline needed to power American competitiveness.

Using NAFSA’s methodology on the economic impact of an international student in 2022, even a one percent change in share would equate to at least $2.1 billion in potential economic impact loss and over 29,000 potential jobs for the US economy by 2024.

The Changing Appeal For A US Degree

The US has long been a global leader in international education, attracting just under one in five international students globally and enrolling 1 million students before the pandemic hit. The US, with abundant capacity for domestic and international students, has 45 institutions listed on the QS World University Rankings. Many students are specifically drawn to programs in the STEM disciplines, which often allow students to gain work experience in their field after graduating. In other countries, pathways from graduation to employment are created to fill critical employment gaps in high-skilled and in-demand fields.

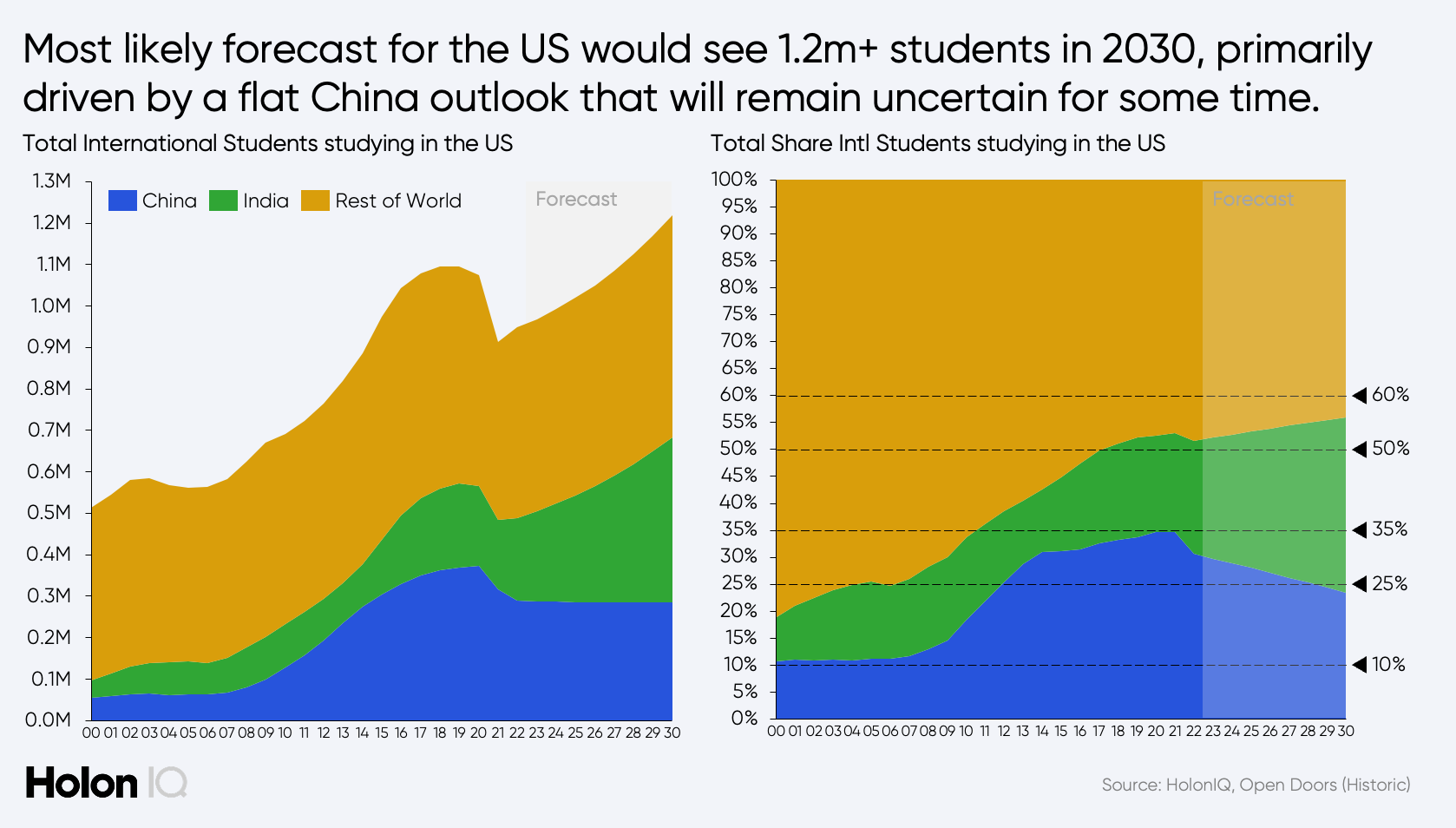

While the US is still regarded as a top-tier destination and a first choice among most international students, several factors contribute to a loss of share. Students from China, which comprised 10% of international students studying in the US in 2000, grew to 35% before the pandemic. Geo-political tensions, increased higher education infrastructure within China, and safety concerns, are among many reasons we are seeing a decline in Chinese students choosing the US. HolonIQ projects that flow from China are expected to plateau between now and 2030.

Other factors impacting student choice include opportunities to participate in post-graduation work programs, and a complicated and often slow visa process with high occurrences of denials can steer students elsewhere. Decades of rising tuition costs and concerns about gun violence and other safety issues are dissuading students and families from choosing the US as a study destination. According to a 2019 survey by the World Education Services, 25% of international students in the US expressed worry about gun violence at their university, and 37% were concerned about gun violence in their broader community.

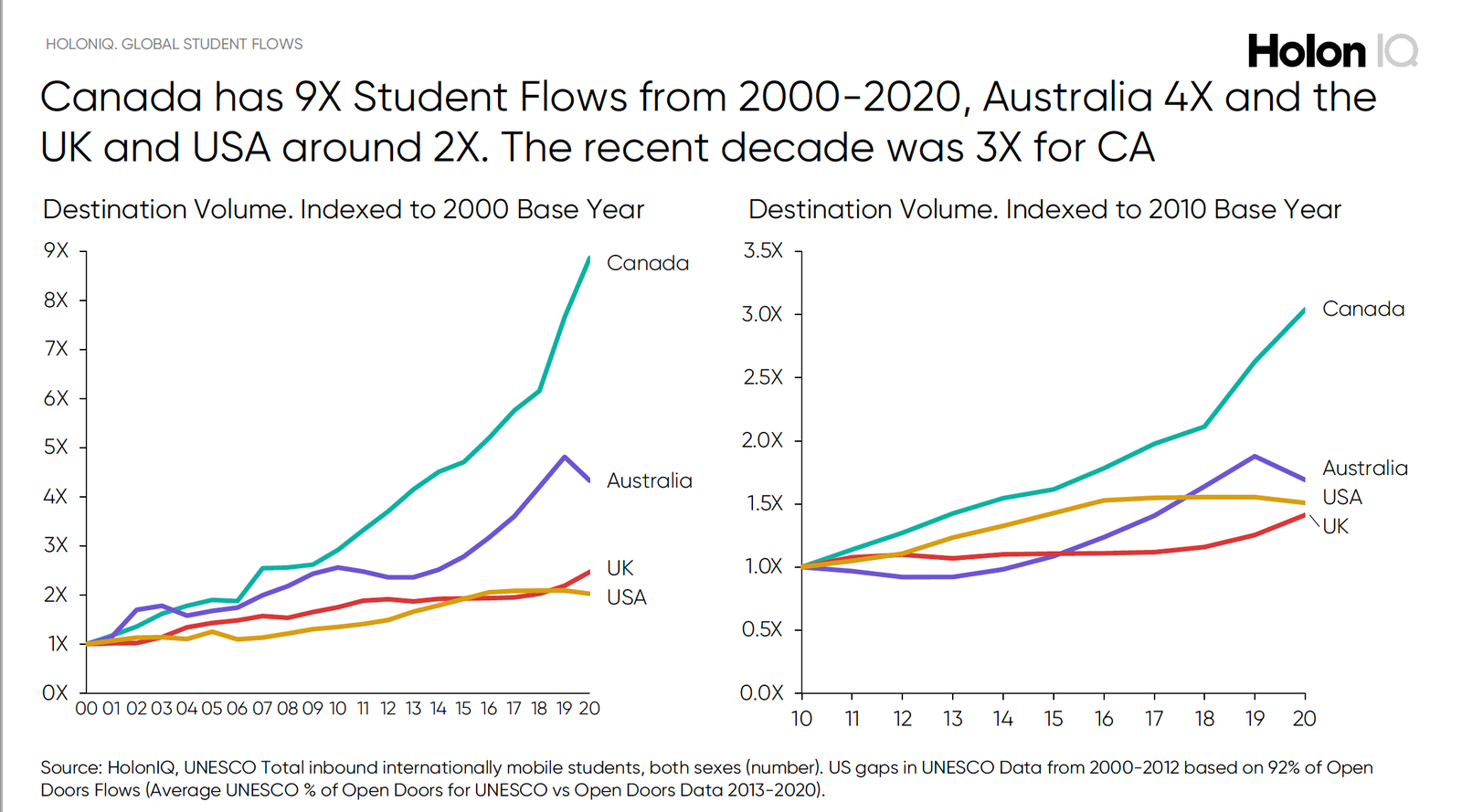

The three other countries in the Big Four of international education (the UK, Australia, and Canada) are taking advantage of increasing demand and deploying a coordinated strategy to recruit students. Canada has increased its flows by 9X between 2000 and 2020, Australia’s flows have increased by 4X, and the UK and US have increased by around 2X, according to HolonIQ.

The US, which used to maintain just under a 60% share of the Big Four in 2000, decreased to under 40%. Today, if the US had held its position in 2000, the market would have an additional 350,000 students and $20 billion of direct expenditure, primarily tuition directed toward US higher education institutions, according to HolonIQ.

What’s At Risk?

Continuing to lose share will have broad implications for the US economy, workforce, and financial health of universities if America does not act.

The US is already facing a prevalent shortage of STEM-educated workers in critical STEM jobs that contribute to US innovation, global competition, and national security, which will be worsened by further loss of share. Domestic birth rates, which have been in decline since the 2008 recession, are exacerbating labor shortages. Unlike global competitors, stagnant policies in the US are restricting international students’ ability to work after graduation and driving students to other destinations.

International students are prepared to rise to the challenge if given the opportunity. Over half the international students in the US are studying or working in STEM, and international students make up over 70% of graduate students in industrial engineering, electrical engineering, and computer and information sciences, according to the Institute of International Education (IIE).

Beyond workforce implications, a lower birth rate and fewer domestic students enrolling in college means US universities have to make up for lost revenue or make reductions that impact the availability of programs and research opportunities. Many universities have turned to international students to fill seats in classrooms to bring in much-needed revenue. In turn, international students contribute diverse perspectives, which adds to learning and benefits all students and the broader campus communities. Capacity at US universities will only continue to grow as the population further declines over the next decade. The US already has the capacity to teach 1 million more international students, according to a recent white paper authored by the Data Catalyst Institute.

Capitalizing On High Demand

In 2021, a joint statement was issued by the US State Department and the US Department of Education, renewing its commitment to international education. Many in the sector cheered this announcement and believed that the US was finally acknowledging the need for a coordinated national strategy to address recent enrollment declines and improve international student policies putting the US on track to regain its role as a global leader in education. However, since the 2021 statement, there have been limited actions to address consular officer capacity and some extensions of interview waivers for qualified applicants. However, there appear to be no plans for a coordinated strategy to attract and retain international talent in the US.

Global competitors have coordinated international student strategies to increase enrollment, and this data illustrates their success. In 2014, the Canadian government set an ambitious goal of attracting 450,000 international students by 2022—double their 2011 numbers. Canada met that goal in 2017. Policies allowing students to work during and post-graduation, pathways to residency, and affordability have been major factors in Canada’s success. In 2019, UK Prime Minister Boris Johnson announced the return of longer post-study work visas for international students, effectively reversing the stricter regulations implemented under Prime Minister Theresa May. The UK set a goal of reaching 600,000 international students by 2025 and reached its goal in 2022, and recently announced international students boost the UK economy by £41.9 billion.

Analysis of other countries confirms that international students’ decision of where to study is heavily influenced by opportunities to work after graduation, ease of navigating the visa process, and affordability. The US can learn from the coordinated policy framework its main competitors have implemented to recruit and retain the world’s top international students. Without significant action, the US will continue to lose its share of international students at great cost to American leadership, innovation, and economic strength.